Build trust with the people who matter

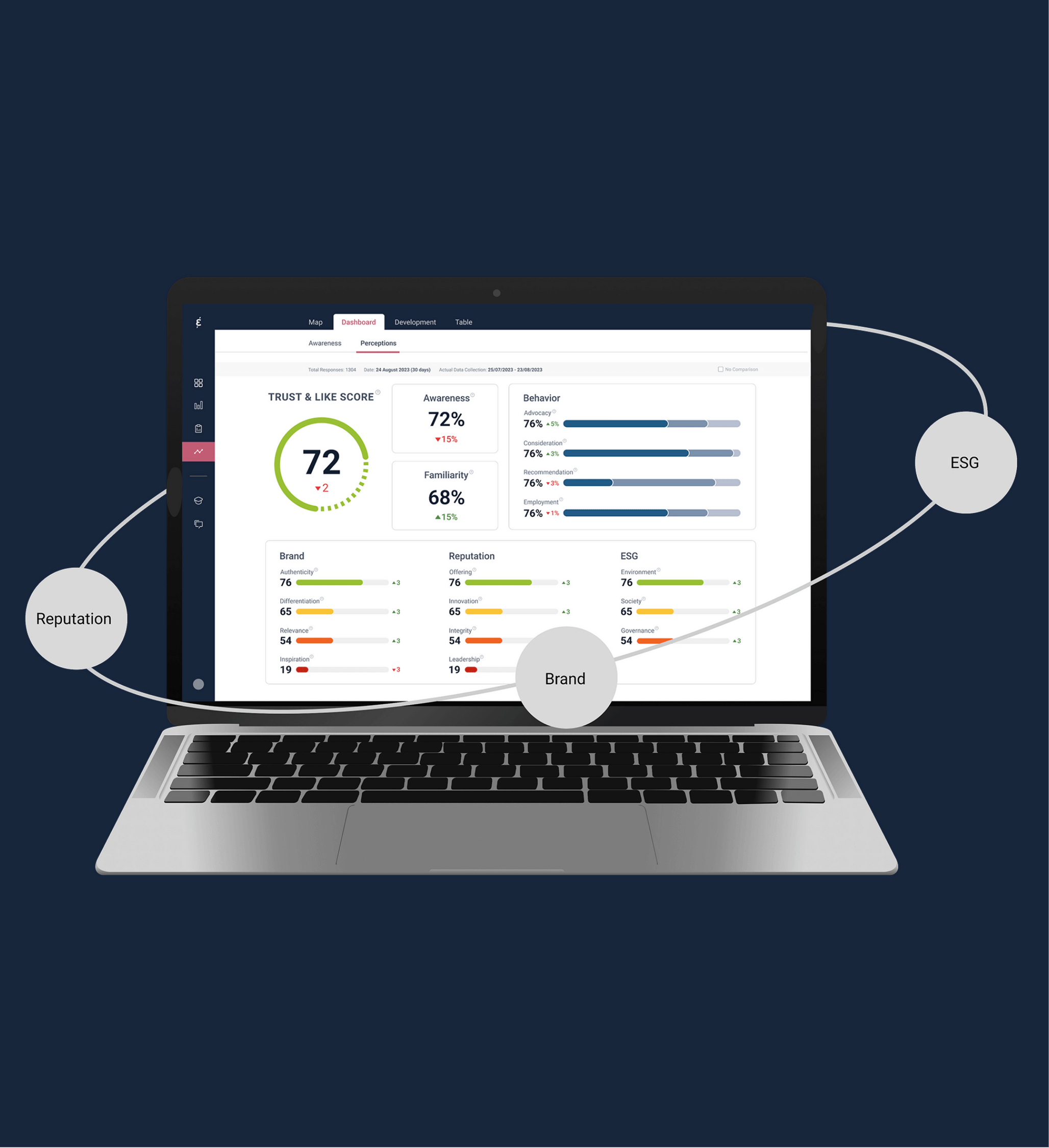

Caliber is the unrivalled source of real-time stakeholder intelligence — capturing what people think, why they think it, and what it means for you.

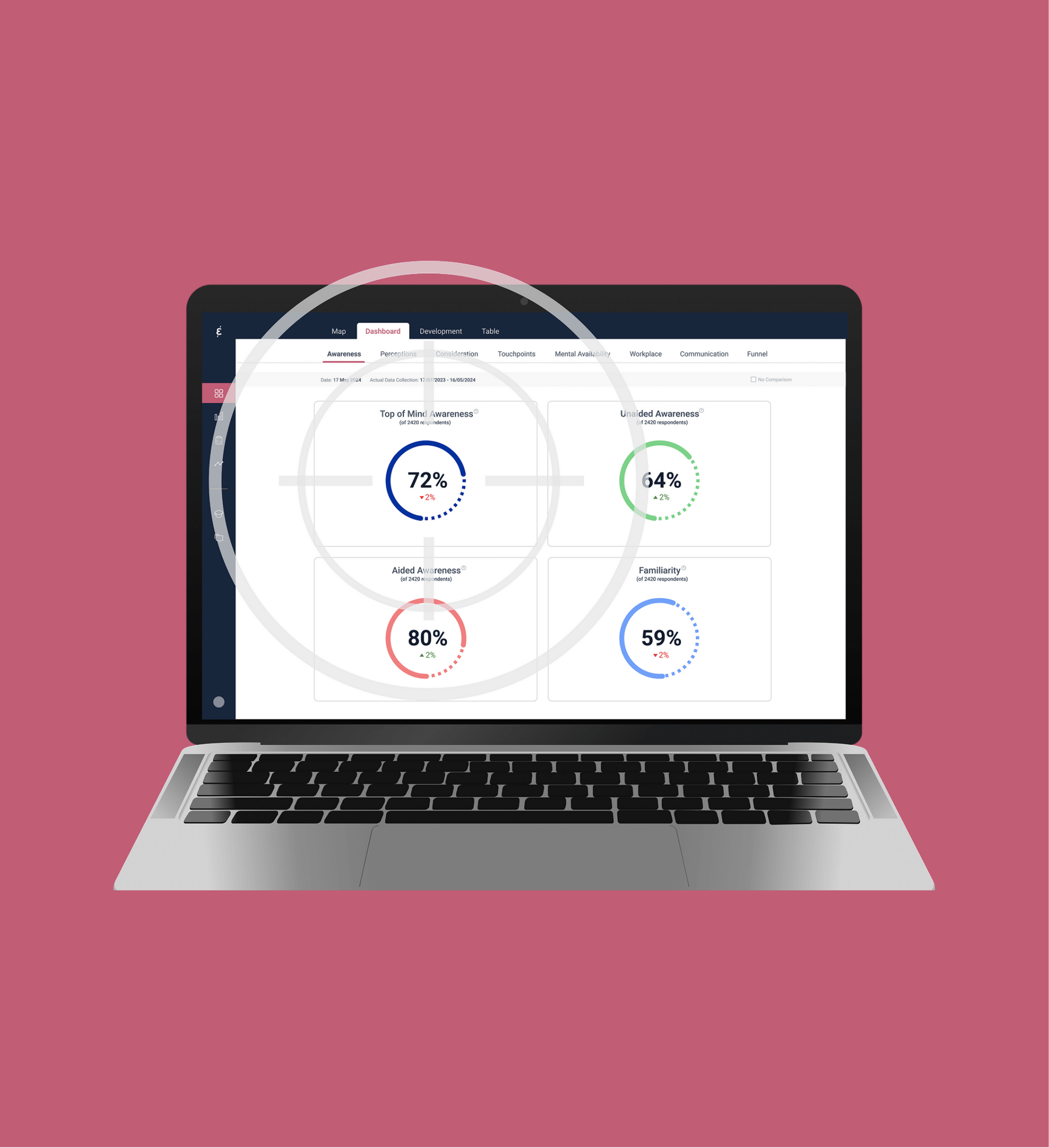

Caliber helps you understand all your stakeholders in real time.

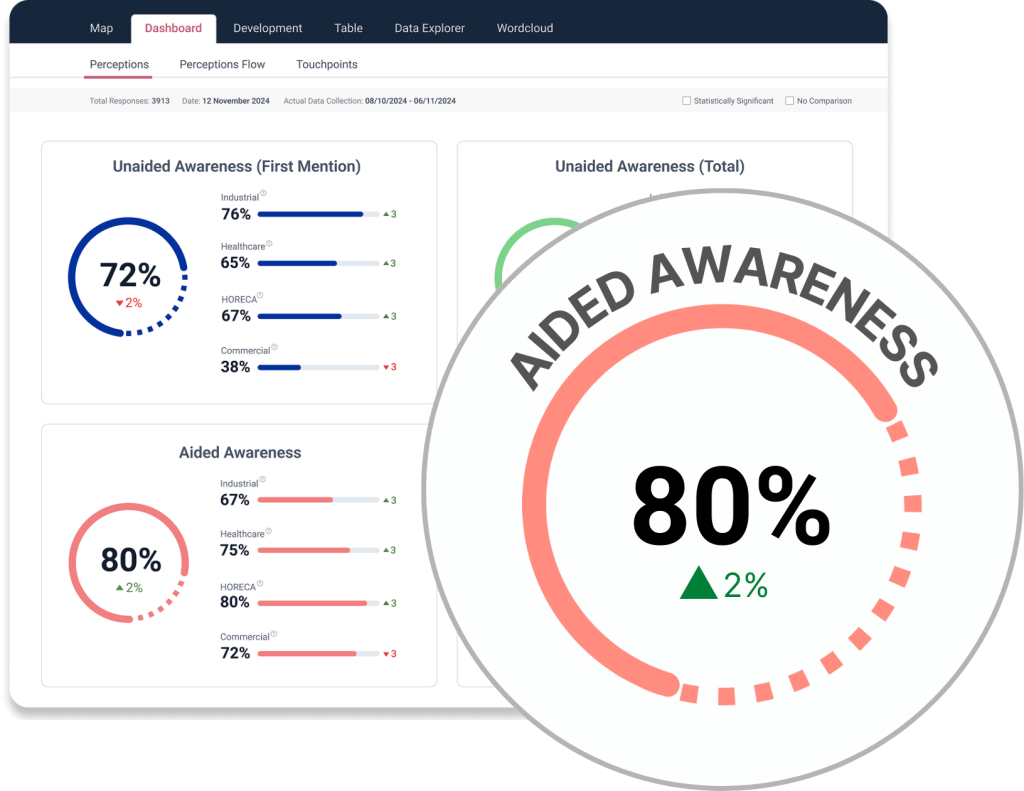

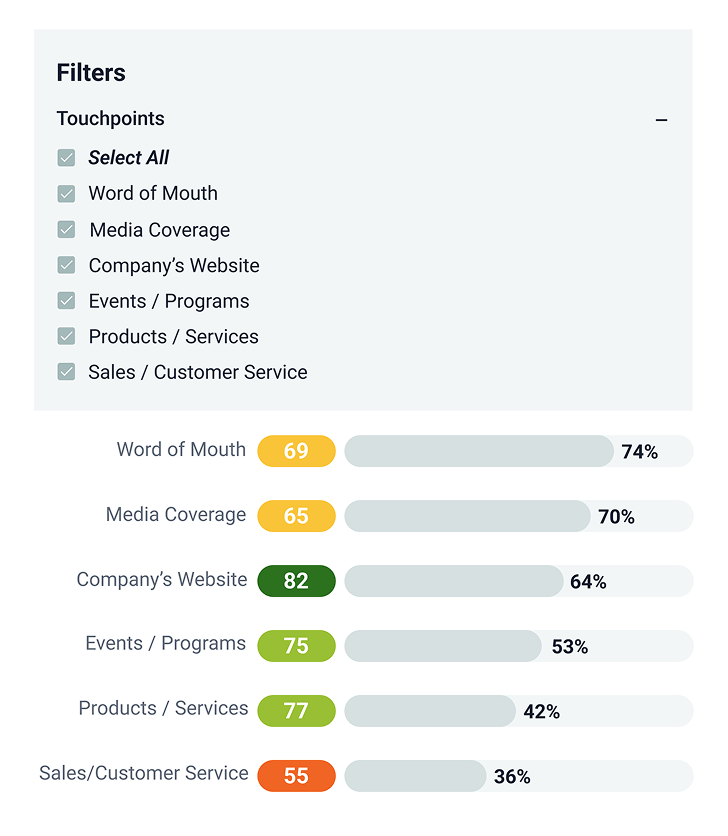

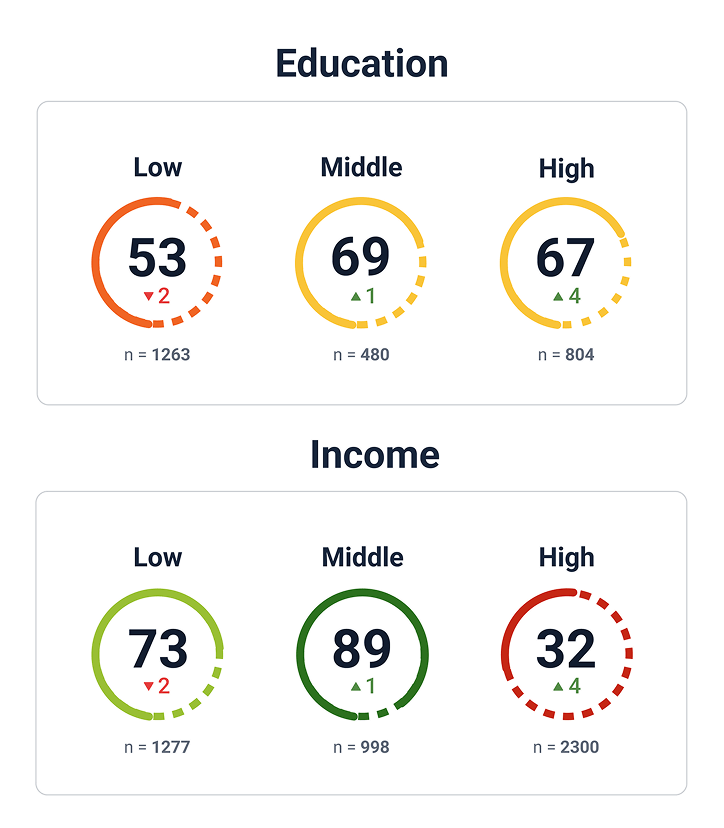

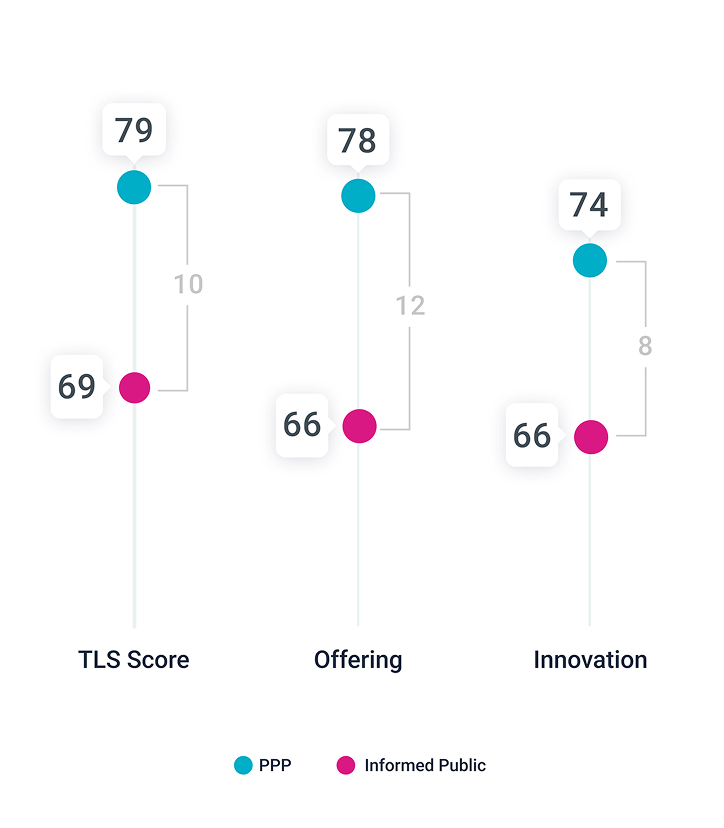

Filter insights by audience, market, or issue for the clarity that matters most.

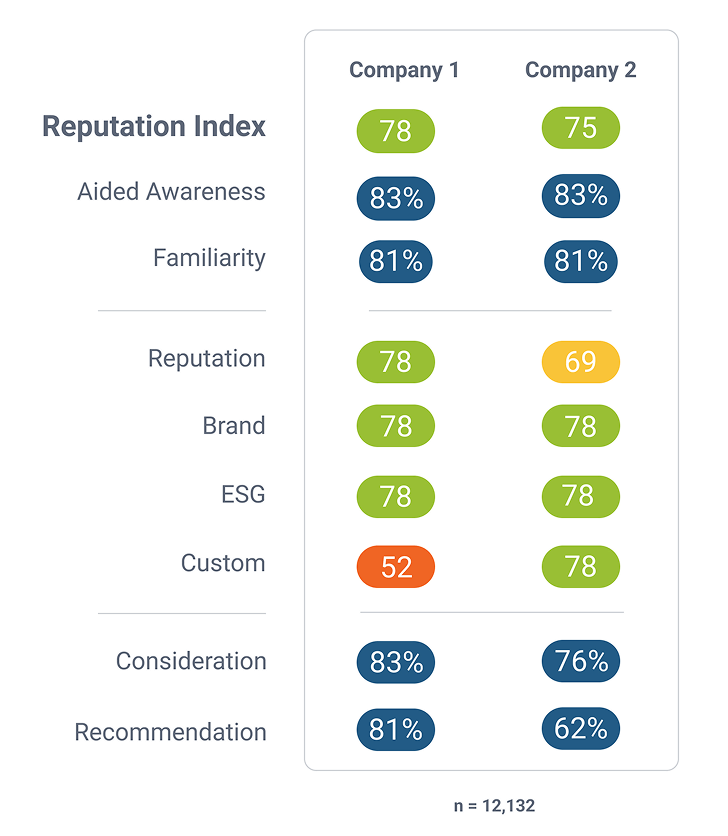

Compare performance across competitors, industries, and time periods.

Thousands of daily stakeholder responses keep your intelligence always current.

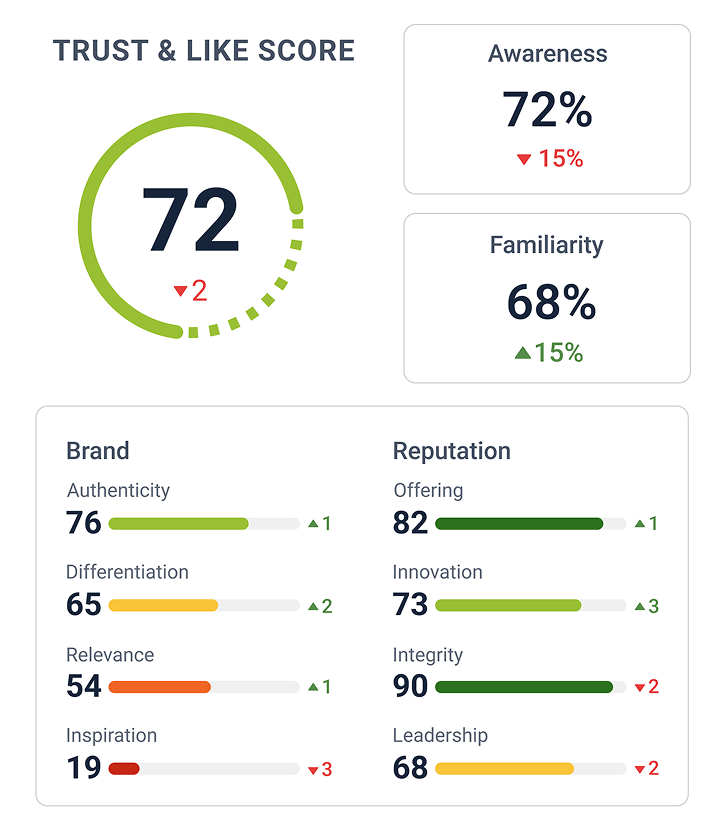

Visualize shifts in trust, reputation, and sentiment through a clean, executive-ready interface.

Sync our data with Power BI, Tableau, or internal dashboards. Integrate stock market data and Polecat media intelligence.

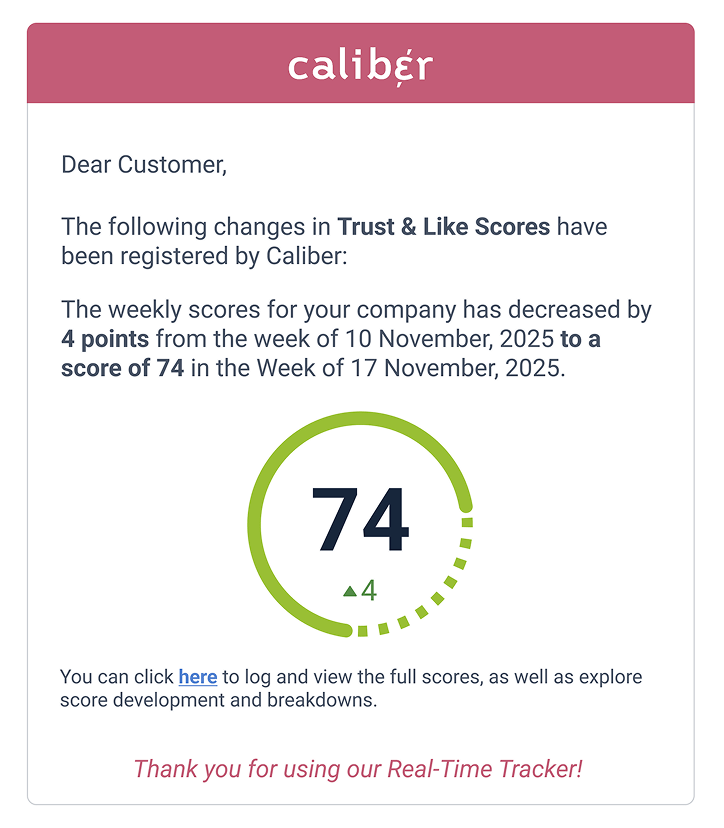

Get notified when perceptions change so you can respond before issues escalate.

Generate tailored analyses for leadership presentations or board updates.

Caliber powers board-level decision-making across communications, marketing, HR, and investor relations.

Track how stakeholders respond to announcements, campaigns, and media events in real time.

Understand what drives preference, advocacy, and trust across audiences.

See how employees and potential talent perceive your organization — and why.

Monitor investor sentiment to anticipate questions and adjust messaging before markets react.

Measure how your actions on sustainability and governance affect reputation and support.

Spot issues early, assess risk levels, and decide when to act — or when silence is smarter.

Choose the right product for your business — or combine both for total visibility.

Our flagship product provides a complete picture of all your stakeholders and markets, giving you total visibility into everyone who shapes your success

Our unique brand tracker zeroes in on one stakeholder group — like employees, suppliers, or investors — to understand what shapes their perceptions and behavior

Our newest product enables organizations to understand their talent pool. It is designed for HR teams to understand the attitudes, perceptions, and behaviours of prospective employees

Caliber gives you everything you need to make smarter decisions about your brand and reputation — powered by next-level reputation monitoring.

Daily data turns stakeholder sentiment into actionable insight — not quarterly reports.

We measure perceptions across every stakeholder group, not just consumers.

Understand what drives perception shifts — from campaigns to crises.

Surveys, media, and external data in one unified ecosystem.

Instant insights and evolving predictive capabilities that help you stay ahead.

Tailored dashboards and survey design aligned with your priorities.

Secure, scalable, and built for global teams.

Used by Fortune 500 companies to strengthen trust, reduce risk, and unlock growth.

Based on science. Trusted by leaders.

Our data isn’t scraped — it’s measured, verified, and statistically robust. When you monitor reputation with Caliber, you get real feedback collected daily and a transparent model that makes sense of it. We surface the signals behind trust, like, and behavior so you always know what’s changing and what to do next.

Continuous surveying of real stakeholders ensures up-to-date, actionable insights.not quarterly reports.

A consistent methodology applied across markets for reliable benchmarking.

Our data predicts stakeholder behavior, and is validated by academic research.

Every metric is traceable to its source. No black-box algorithms — just credible, explainable data.

Interviews conducted so far, with thousands added every day

Companies monitored worldwide, including largest players across all sectors

Countries in which we track perceptions of different companies and industries

Join the organisations already using Caliber to gather business-critical stakeholder intelligence.

Get actionable insights about the people who matter most — and see the impact across your business.

Fill out the form below to talk to our stakeholder intelligence experts

It’s the ongoing measurement of how stakeholders perceive your brand. Caliber captures both rational dimensions (e.g., integrity, innovation) and emotional attachment (trust and liking) to reveal true reputation strength.

It involves listening, measuring, and analyzing stakeholder sentiment and brand reputation. Caliber applies its validated Trust & Like, Reputation, and Brand indices for a complete analysis of stakeholder perception.

Social media monitoring captures online chatter. Reputation tracking measures trust and perception. Caliber integrates both — blending media sentiment with stakeholder intelligence for a full reputation view.

Top platforms include Caliber, Signal AI, RepTrak, Talkwalker, and Meltwater. Caliber excels at connecting perception data with business outcomes — showing not only what’s said but what people believe.

It helps identify emerging risks, communication opportunities, and stakeholder misalignments. Caliber users apply it to evaluate campaigns, track ESG perception, and measure crisis impact — turning data into clear actions.

The most effective combine real-time data, multi-source inputs, and predictive analytics. Caliber does exactly that — merging stakeholder surveys with media intelligence into a single, trusted reputation view.

Look for:

Caliber combines all these in one unified platform.