In 2021, we started to trust businesses a little bit more. While the pandemic still cast a shadow over the financial outlooks and operations of the OMX C25 companies, things were starting to look better with a looming return to normal.

Though there was a great deal of volatility in perceptions over the past year, most companies in the index saw their year-on-year Trust & Like Score (TLS) stay the same or even improve. As we now emerge on the other side of COVID-19, most companies appear to have recovered to the TLS levels they had prior to the pandemic.

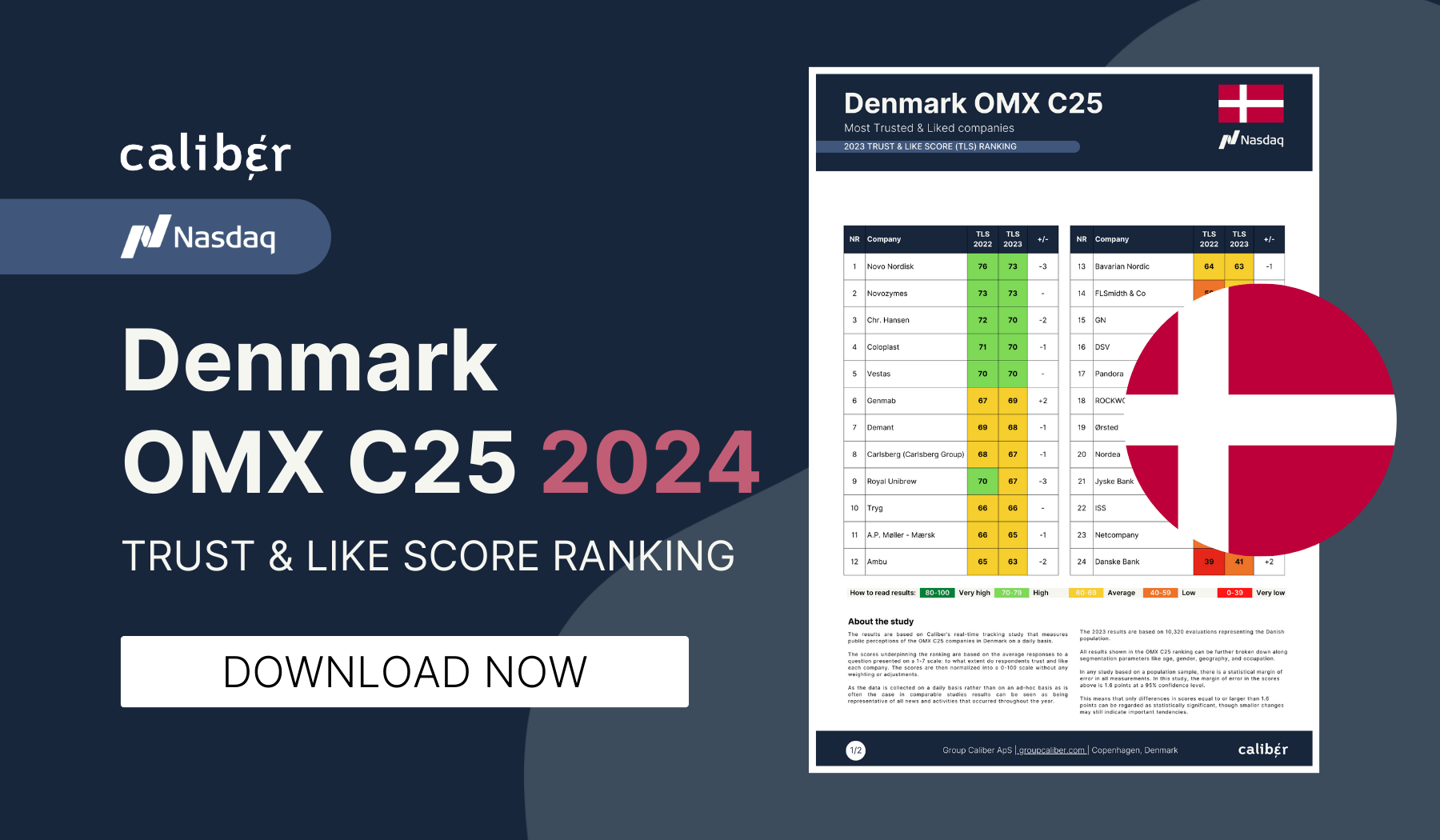

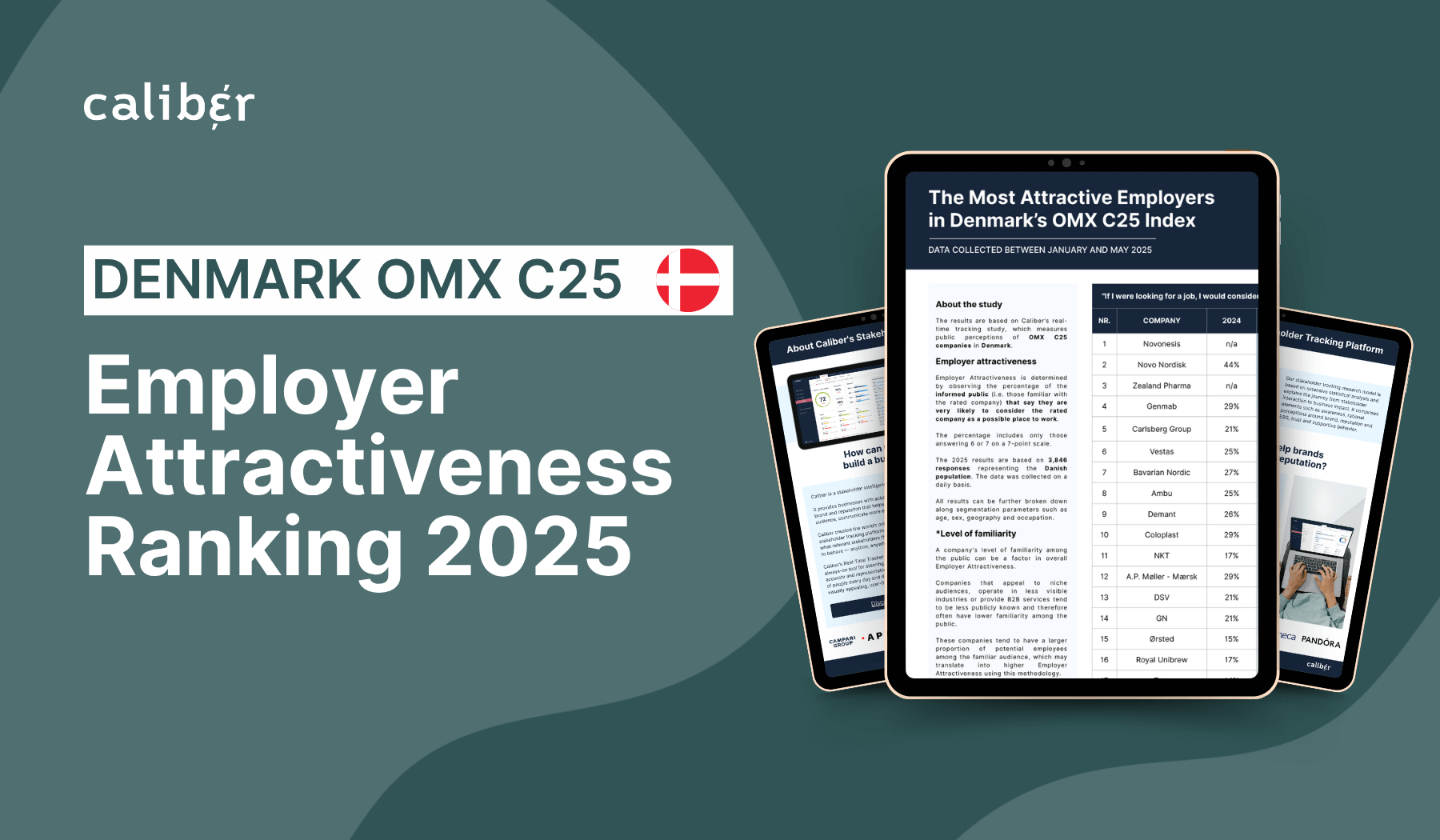

For the fourth year in a row, Novo Nordisk claims the top spot in the OMX C25 index ranking. The company continues to hold by far the best perception among Danish stakeholders and sits solidly 3 points above Novozymes in second place and 4 points above Chr. Hansen and Vestas shared third place. The top-5 ranking is rounded off by Carlsberg, which maintains the climb it had in 2020.

In 2021, the company once again had very strong business performance, winning key market shares and delighting investors with a strong pipeline.

However, looking at the full perception profile of Novo Nordisk, we can see that its strong reputation is made up of more than positive perceptions of its products and innovation. The company steadily navigated through the pandemic while growing its business throughout. The perception of Novo Nordisk as an inspiring leader is one of the factors that make the company stand out.

Novozymes, Chr. Hansen and Vestas are the companies in the closest pursuit of Novo Nordisk. While all these companies target a B2B segment and are not something that consumers directly associate with, they all represent ingenuity and inspiration, providing solutions that benefit society at large. This is a central theme for most of the companies at the top of the OMX C25 index ranking.

Simcorp, which was introduced as a new company to the index in 2021, is the highest climber with a 3-point increase. Novozymes, Royal Unibrew, GN, Lundbeck, and Ørsted all increased perceptions by 2 points. The two latter recorded their best perception score since Caliber started tracking the OMX C25 index.

At the other end of the ranking, we continue to find Netcompany, Pandora, ISS, and Danske Bank. Danske Bank fails to follow up their strong rebound of 2020 that saw them increase by 5 points. In 2021, the status quo for the bank means that they are still decidedly the OMX C25 company with the worst public perception.

It has been two long years for everybody – also for OMX C25 companies having to deal with an uncertain market, delayed supply chains, lockdowns, etc. In the first year of the pandemic, the index saw a significant negative impact on perceptions likely due to stakeholders fearing the worst in terms of the ability of companies to navigate through the crisis.

Already in 2020 much of the loss of trust was recovered, and faster than in other markets, showing the general strength and resilience of companies in the OMX C25 index.

In 2021, the recovery continues, albeit with more volatility in perceptions due to the ebb and flow of COVID-19 cases and resulting lockdowns, as well as some negative financial results. None of these events, however, had a sustained impact, and the average perception score for the index climbs slightly higher compared to 2020.

The stability and perhaps slight optimism in the index results through 2021, as well as the fact that several of the companies set new score records show that the reputations of Danish businesses have fully recovered from the pandemic.

With the pandemic all but gone, companies are now facing a new reality. In the past 5-10 years we’ve seen stakeholders starting to raise their expectations of companies and placing more trust in companies that help change global agendas, as recently shown in the 2022 Edelman Trust Barometer.

People are expecting companies to do more for the benefit of society, which is also why we in Denmark see companies like Novo Nordisk, Novozymes, and Chr. Hansen ranks highest in perceptions.

From our global data, we are also beginning to see this in a new convergence of drivers of perception. What this means is that trust and affinity are now more than ever dependent on companies delivering both strong products and innovation, as well as showing a strong purpose and societal benefit.

This will be the next battleground for companies seeking to win the hearts and minds of their stakeholders and ensure that people will continue to buy their products, recommend them to others or even come and work for them.