To protect their reputation, companies shouldn’t just rely on media monitoring, social listening, or periodic research – they should gather stakeholder intelligence in real time.

Most companies have many stakeholders, from employees and customers to investors and media. Knowing what their stakeholders think of them can help businesses build and maintain good relationships — and communicate more effectively — with them.

To find out what stakeholders think, too many companies believe it’s enough to use a media monitoring service. Or do “social listening” to see what people are saying about them on social media. Or commission periodic research like an annual survey.

Despite their benefits, all three methods have serious limitations. All three paint an incomplete picture of what stakeholders think. All three are of limited use to communications teams looking to demonstrate the impact, value, and ROI of their work.

Below is our guide to the pros and cons of each method – and why gathering stakeholder intelligence in real time is the only way to get a complete picture of what the audiences that matter think and why it matters.

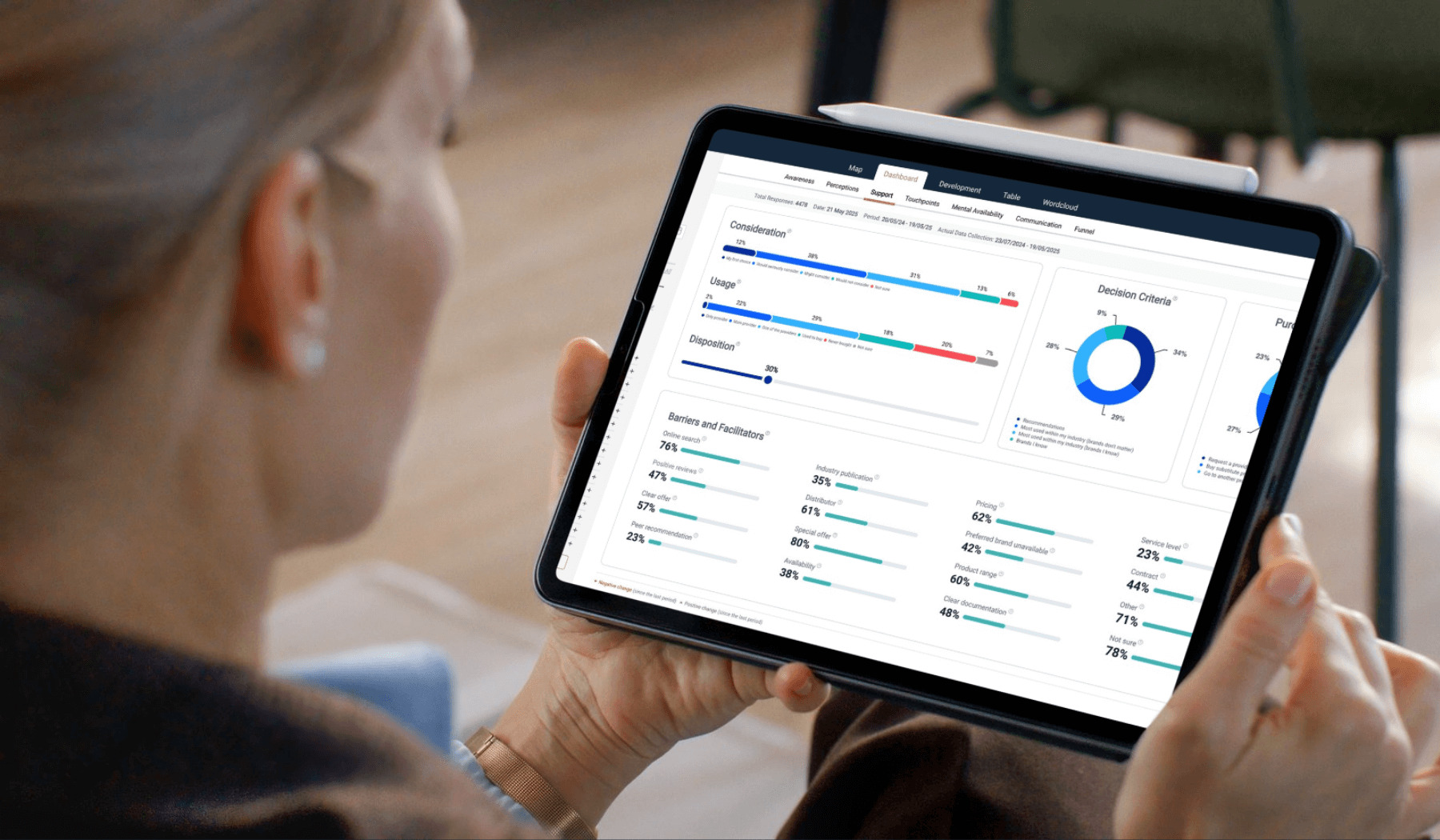

That’s priceless if a company wants to know how well, say, a product launch or crisis response is going – and tweak its communications accordingly.

This nimbleness is especially critical for companies required to react to unforeseen external events — especially macro-events such as wars or natural disasters. To inform their stance and gauge reactions to it, real-time data from target audiences is priceless.