Our latest report shines a light on the Telecom sector — and shows the current reputation of its biggest companies.

Telecommunications companies connect the world, fuel economic growth, and drive innovation in the digital realm.

Without them, the world would be a lonelier, more atomized place.

But as our most recent reputation report shows, telecommunications companies have their work cut out.

The telecom sector got an overall Trust & Like Score — our chief reputational metric — of 65.

A company’s Trust & Like Score is based on the degree to which survey respondents say they trust and like that company, meaning the sectoral score is the average of all companies.

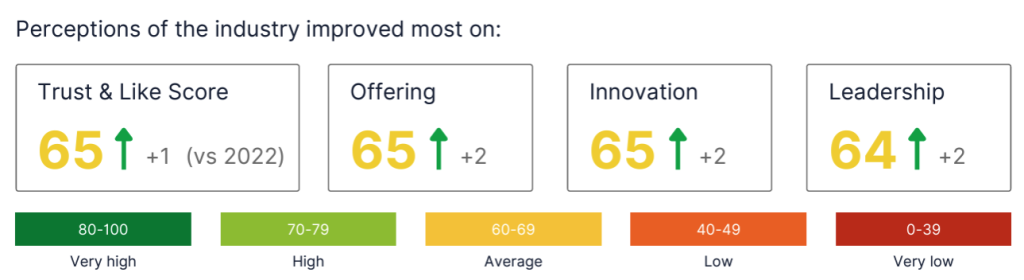

The good news for the telecommunications sector is that it was perceived more favorably last year than it was in 2022.

Perceptions of almost every brand and reputation attribute improved for the global sector in 2023.

Moreover, people are more likely to support, consider or recommend telecom companies than a year ago.

The bad news for the telecommunications sector is that its Trust & Like Score of 65 is merely Average.

And of the 16 global industries that Caliber tracks, the telecom sector still has one of the worst reputations.

In fact, it’s better only than the energy sector.

Moreover, ESG scores failed to improve in 2023, with the average Society score for telecommunications companies falling in 2023.

And fewer than a third of respondents would consider seeking a job in the telecom sector, unchanged from 2022.

It’s hard to say why, but frequent coverage of job losses across the sector in 2023, as well as persistent concerns — and headlines — about data security, overcharging and contract transparency, may have influenced people’s perceptions.

Below, we take a look at which telecommunications companies topped this year’s list.

Together, they’re helping shape the future of the world’s telecom sector.

To get a better sense of what’s driving their strong reputation — in other words, what makes these telecommunications companies more trustworthy and likable — we took a closer look at their relative reputational advantages.

In other words, the brand and reputation attributes where they were rated exceptionally favorably compared to other companies in their market.

In short, the top-rated telecommunications companies in many markets are perceived as being more innovative and behaving responsibly.

As the list below shows, that’s because four of the eight market-leading telecom companies had Integrity as a top three “relative reputational advantage”, and four had Innovation.

Three companies had Leadership, and three had Authenticity.

Known as France Télécom until it rebranded as Orange in 2013, the company now operates in 26 countries and boasts 298 million customers.

As Orange continues to expand its global footprint under CEO Christel Heydemann, it remains the French telecommunications company with the best reputation among stakeholders; a 2023 study by French regulatory authority Arcep showed it beating its competitors in most metrics.

Trust & Like Score: 65

Key relative reputational advantages: Integrity; Leadership; Authenticity

Deutsche Telekom is one of the world’s leading integrated telecommunications companies. A state enterprise privatized in 1995, it today boasts 252 million mobile customers, 25 million fixed-network lines, and 22 million broadband lines.

The Bonn-based company is also “developing from a classic telephone company into a service company of a completely new type: the software company that sells telecommunications services.”

Trust & Like Score: 64

Key relative reputational advantages: Leadership; Innovation; Relevance

Founded a century ago, Telefónica is a Spanish multinational telecommunications company headquartered in Madrid — and one of the world’s largest telephone operators and mobile network providers. It operates in the UK under the O2 brand. Headquartered in Reading, O2 is the UK’s largest mobile network operator, with around 24 million subscribers. It has also sponsored the England rugby team, Arsenal football club, and a string of music venues.

Trust & Like Score: 62

Key relative reputational advantages: Society; Integrity; Authenticity

Established in 1983 and originally known as Bell Atlantic, Verizon is now a household name in the US. Headquartered in New York City, it is one of the world’s largest communication technology companies, generating $134 billion in revenue in 2023. Signaling its commitment to driving digital transformation and innovation, Verizon’s network covers 99% of the US population, making it one of the largest wireless carriers in the country.

Trust & Like Score: 65

Key relative reputational advantages: Innovation; Inspiration; Differentiation

China Mobile, founded in Hong Kong in 1997, boasts the largest subscriber base of any telecommunications company globally, with 985 million mobile customers nationwide and 286 million wireline broadband customers.

In 2023, the company deployed 360,000 5G base stations across China, taking its total to 1.7 million and 85% penetration, while in early 2024, it claimed to have launched the first 6G test satellite.

Trust & Like Score: 78

Key relative reputational advantages: Innovation; Society; Inspiration

Founded in 2003, and part of the Telefónica Group since 2010, Vivo is Brazil’s largest telecommunications company. Its purpose is to bring society closer through digitalization and help transform lives by building a more connected nation.

Headquartered in São Paulo, Vivo now leads the Brazilian mobile market: it operates 99.1 million lines — almost 40% of the total active lines in Brazil — and covers more than 96% of the population with its 4G network. Vivo has also long been a sponsor of the Brazilian national football teams.

Trust & Like Score: 77

Key relative reputational advantages: Innovation; Offering; Leadership

Founded in 1990 and headquartered in Mexico City, AT&T Mexico is a subsidiary of the US telecommunications giant AT&T.

Today, it’s one of the three biggest telecommunications companies in Mexico, with more than 22.3 million customers by the end of 2023.

According to its parent company, AT&T Mexico’s 5G network had reached 47 cities by the end of 2023. It also made headlines with its innovative digital solutions for small and medium-sized enterprises.

Trust & Like Score: 78

Key relative reputational advantages: Governance; Integrity; Authenticity

The vision of Japanese telecommunications giant KDDI is to be the company that customers feel closest to, that continues to produce excitement and that contributes to the sustainable growth of society.

It boasts around 63 million mobile phone customers, and in 2023 agreed with rival NTT to collaborate in developing 6G optical technology — paving the way for ultra-energy-efficient networks that use light to transmit signals.

Trust & Like Score: 59

Key relative reputational advantages: Inspiration; Governance; Integrity

Our report on perceptions of the world’s telecommunications companies illuminates what’s driving their reputations and what threatens them.

Based on a global survey of almost 6,000 people, the report reveals perceptions of the sector are improving — with people more likely to support, consider or recommend telecom companies than in 2022.

Telecommunications companies are also seen as more innovative and as having a stronger offering — possibly because many are diversifying beyond connectivity into media and entertainment services.

Moreover, almost a quarter of people globally (23%) say they perceive the telecom sector as better than it was five years ago, with just 6% saying they perceive it as worse.

Our report reveals some of the challenges facing the telecom sector — and provides insights not only into what’s driving the sector’s relatively poor reputation but also how it can fix it.

First, we asked respondents what they thought could most harm the telecom sector in the future.

Globally, the top three answers were:

We asked stakeholders what telecommunications companies should focus on to stand out from their competitors and attract and retain customers.

Globally, the top three answers were:

Finally, we asked respondents how the telecom sector could contribute more positively to society.

Globally, the top three answers were:

For telecommunications companies looking to change how stakeholders perceive them, the solutions arguably lie in the problems themselves.

To improve their reputation, telecommunications companies need to acknowledge and address concerns about data breaches and deceptive advertising, improve customer service, provide more reliable coverage, and introduce much more transparent pricing.

Older customers would certainly welcome these developments. For instance, more than half of respondents over 45 said they want the sector to make their services affordable for underserved communities, including those in rural regions. Likewise, more than half of over-45s said privacy breaches could most harm the sector’s reputation in the future.

In short, older customers are worried about cybersecurity and affordability — and they also think providing consistently reliable network coverage is the number one way that telecommunications companies can attract and retain customers.

Sitting just outside the top three answers for how the telecom sector could contribute more positively to society were the following:

Meanwhile, almost one in five 18–24-year-olds (19%) said they thought telecom companies should implement programs that positively impact society, like supporting education and healthcare.

In conclusion, the solution for a sector with a reputation problem shouldn’t just be to fix existing problems or address customer concerns.

It should be about being more ethical, sustainable, and socially impactful. Of course, picking up a signal is one thing: for global telecom companies today, the trick is making the right call.

Download the global reputation report today. Alternatively, contact us today to learn more about how we can help your company better understand its stakeholders and become more trusted.

Our latest report shines a light on the Telecom sector — and shows the current reputation of its biggest companies.

© 2024 Group Caliber | All Rights Reserved | VAT: DK39314320