At Caliber, we believe that companies – like people – need to possess a strong character in order to be liked and trusted by those around them. And while having character is often associated with being unique and memorable, a strong character also means having integrity.

People with strong character benefit from the resulting trust and affection by having tighter and wider networks of friends and allies. Similarly, companies with a strong character win customers, ambassadors, and greater loyalty from important stakeholders such as employees, investors, and partners.

Since we believe a strong character is reflected by being trusted and liked, we measure a company’s perceived character by quantifying the strength of these two emotions.

In Denmark, we measure that on a regular basis through our syndicated research, which covers the country’s most prominent companies, as measured by their turnover, number of employees, familiarity among the general public, market share, and other similar criteria.

Why do we do that? Because it allows us and our clients to better understand what drives people’s perceptions, how fast, how often, and for how long.

This means that we all get smarter and better at learning from the past and present when planning the future and making concrete decisions.

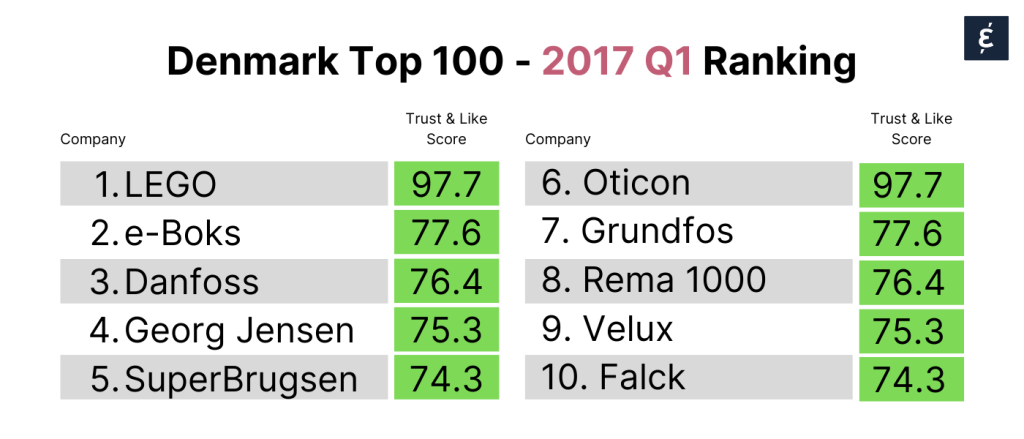

We recently published this year’s first quarterly ranking of 100 companies based on the scores generated in January, February, and March 2017. These were the top 10 most liked and trusted companies in Denmark.

While some measure stakeholder perceptions on an annual or bi-annual basis, we choose to do so daily and review scores week by week, month by month, and quarter by quarter.

For example, here are a few things we learned when reviewing the changes in scores throughout the first quarter of 2017.

Companies in the top 10 represent various industries, from toy manufacturing, food retail, and manufacturing of pumps and electrical motors to jewelry, emergency services, and hearing aids.

With that said, the sector still matters. In Q1, Banking, Insurance, Energy, Telecom, and Transportation/Logistics seem to be the sectors that the Danish public “loves to hate”, with companies in these sectors ranking low on our list.

In some cases, it may be due to a monopolistic heritage; in others perhaps the perceived lack of transparency or understanding by the public. Interestingly, though, there seem to be some notable exceptions. GLS is one of them.

GLS is among the biggest climbers in trust & affection score this quarter, widening the gap between its score and that of the troubled PostNord – showing that a logistics company can still gain significant goodwill from the public by offering easily accessible, competitively priced, and good quality services.

The GAFA companies (Google, Apple, Facebook, Amazon) – while admired globally for their innovation dominance – have for a while now been far from the Danes’ favorites.

In Q1 they all score in the weak or average tiers, with Facebook being the weakest, followed by Apple (traditionally a favorite, also in Denmark, but no longer trusted or liked as before).

However, Facebook’s trust & affection score rose more than any other company in Q1, suggesting its moves to tackle fake news are winning public endorsement and may start mending the long-held negative perceptions towards it.

Another climber is Amazon, whose score has risen steadily over the last six months to rival that of major retailers like Magasin du Nord, H&M, and Jysk.

Given the fall or stagnation during the same period of Bilka, Føtex, and Netto, it seems like Dansk Supermarked’s attempt to “unite the Danish retailers in the fight against Amazon” may face some challenges as far as public sentiment is concerned.

One of the biggest financial losses in Danish corporate history didn’t seem to bother the public much – A.P. Møller-Mærsk’s trust & affection score remained largely unchanged throughout the first quarter of 2017 with a very modest (around 1-point) decline in January when news first came out, and no change in February upon the official announcement.

While the public understands the company is facing commercial challenges, the heritage seems strong enough to prevent negative news from damaging the well-established positive perceptions of this “Danish darling”. This is a clear example of how a strong corporate character acts as a buffer from the impact of negative news on public perceptions.

While DR has traditionally enjoyed better perceptions than TV2 in the Danish market, the situation has flipped in the first quarter of 2017 with TV2 demonstrating one of the biggest rises and DR one of the biggest falls.

This could potentially be related to the tough few months DR has had, with stories about reporters flying horses to America at the taxpayer’s expense, a radio program illegally “making a few bucks on the side” and abusing poor café owners, and the symphony orchestra fighting for its existence. The beneficiary is clearly TV2.

Ever since the publication of Caliber’s 2017 first-quarter Top 100 review in Finans, we have been repeatedly approached by companies, journalists, and other interested people with the same question: Why are some companies trusted and liked while others are not?

This simple question is unfortunately not straightforward to answer. Indeed, all companies are different and find themselves in unique situations – though some general principles seem to be applicable to all.

Such situations can be crisis-related (e.g., PostNord and DSB), being part of a specific industry (like Nordea and the GAFA companies), or being of local origin (as with Danfoss, Grundfos, and LEGO).

At the same time, there are often exceptions. So, what exactly do companies that succeed in gaining trust and affection have in common?

This is the question we try to address in this 2017 Q2 review of Denmark’s Top 100 companies.

Clearly, DR is no longer just radio and TV2 is more than just television, but the reputational cat-and-mouse game between the two state-owned Danish broadcasters has taken a surprising turn.

DR, which was once the unquestionable pride and joy of most Danes, has taken a serious beating to its reputation in 2017 – dropping by nearly 6 points. TV2, on the other hand, has improved by 1.4 points, putting it for the first time ahead of DR by a whopping 18 positions in the 2017 ranking.

This reversal of image was thought impossible until not long ago – will it continue in 2018? Much depends on the political debate over the unloved license fee in Denmark.

If Novo Nordisk was our nominated “icon that has fallen from reputational grace” last year – this year it’s Mærsk. The Danish shipping and energy giant had managed to maintain its reputation despite unprecedented financial losses in 2016, but as dramatic news kept coming in 2017 – its reputation could hold no longer.

The splitting of the company into two separate companies and the subsequent sale of its oil & gas activities to Total have resulted in a consistent drop in its trust & affection score in every quarter of 2017.

In Q4 A.P. Møller – Mærsk was ranked 47th in the top 100 list – down from the 25th position in Q1. A fall from grace indeed.

Quite a lot if you ask Ørsted – formerly known as DONG. The company changed its name in early November to signal the completion of its move from oil and gas to renewable energy.

As far as public perceptions in Denmark go, this seems to have done the trick – the company’s trust & affection score has been rising consistently since then, and it seems to be on track to move from the “low” reputation tier to the “average” one.

It is still not in the upper half of the top 100 list, but as an energy company, it’s well-perceived and has a positive trajectory.

The above are just a few examples of the insights coming out of our daily tracking of prominent companies in Denmark.

Some other patterns we notice are the rise of foreign discount retailers like Lidl, Aldi, and Rema 1000 – who have all done extremely well reputation-wise in Denmark in 2017 – and the significant strengthening of DSB’s reputation from Q1 to Q4 after many years of reputational troubles – possibly due to its decision to withdraw the much-maligned IC4 trains. Y

ou can read more stories about our top 100 ranking of 2017 in the Finans coverage (in Danish) or contact us for more information.

Winning public trust and affection is a tricky thing – sometimes, chasing it will lead you in the opposite direction. As we often say, trust and affection are the outcomes of having a strong and lasting character. And character, in its simplest form, is about having a unique purpose and acting with integrity.

In even simpler terms, create or deliver something that people want in a way that is unique to you and does no harm. But demonstrating and staying true to character is a never-ending task, one that is not easy for a company to manage and enforce over time. Cases like Rema 1000 and DSV show the benefits of getting it right.

We will keep monitoring public perceptions and keep sharing with you the most interesting findings. Meanwhile, we wish everyone a successful 2018 in both reality and perception!

As we continue to work with companies to help them articulate and demonstrate a strong, authentic, and unique character – we will keep placing a premium on stakeholder perceptions: their nature and evolution bring invaluable insights to unlocking a company’s unique value drivers and guiding concrete actions that ensure not only that the company stays true to its character, but that it also reaps the full benefits of that.

If you would like to learn more about the public trust and affection towards your company and better understand your position in the rankings feel free to contact us at [email protected].

© 2024 Group Caliber | All Rights Reserved | VAT: DK39314320