The financial industry manages to maintain stability in public perceptions, but some audiences turn critical.

In March 2023, three midsized US banks failed, triggering a sharp decline in global bank stock prices and a swift response by regulators to prevent potential global contagion.

The turmoil has led to the seizure of Silicon Valley Bank and Signature Bank, the private-sector bailout of the U.S. regional lender First Republic Bank, and the takeover of the troubled Swiss bank Credit Suisse by its rival, UBS.

We turned to the Caliber Global Banking Index to explore the reputational impact.

The index measures public perceptions of the world’s largest banks across Brazil, China, France, Germany, Japan, UK and USA through daily online surveys.

In the week commencing March 13th – immediately following the collapse of Silicon Valley Bank – the global Trust & Like Score (TLS) of the banking sector, measured on a 0-100 scale, actually increased by 1 point, suggesting no immediate negative impact.

TLS did drop by 5 points in the following week, but then fully recovered a week after.

While the score remained volatile in subsequent weeks, it reached the same level of 67 points for the month of April – an average-tier reputation score, but the highest for the sector since January 2021.

When breaking down results by country, perceptions of the banking sector in France are the only ones dropping significantly – down 4 points when comparing the year’s first 10 weeks up to the SVB collapse, with the subsequent weeks up to the end of April, suggesting a weakening of public trust and affection towards French banks.

Of the 3 banks that make up the index in France, it is Société Générale whose reputation deteriorates in the immediate aftermath – and continues to do so into May.

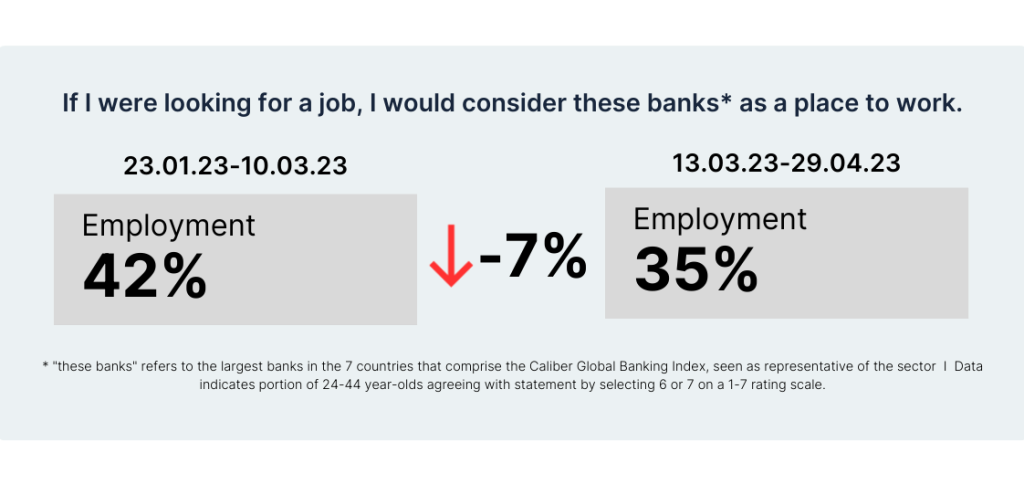

The indicator that seems to be trending downwards for the banking sector since the crisis erupted is the Employment score – down 3%-points as a global average in the 6 weeks that have gone by since SVB’s collapse, and even more so among 25 to 44 year-olds, the most relevant age group for talent and customer segments: a 7%-point drop.

The sector seems to have weathered the storm reputationally, but is becoming less attractive to talent as a result.

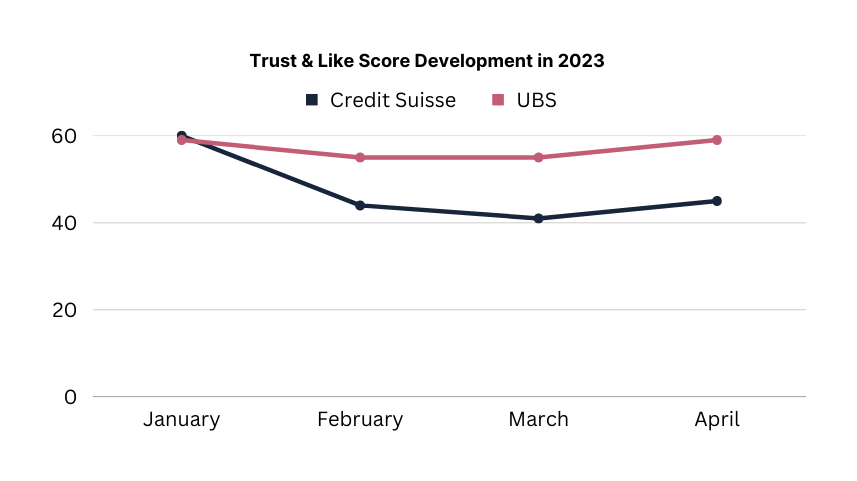

The Credit Suisse bailout by UBS is clearly reflected in our reputation data, showing that while the two banks had similar reputation levels in Switzerland prior to the crisis, they now have a significant gap in their respective Trust & Like Score of more than 10 points.

This suggests that the crisis did in fact impact public perceptions, but that the impact was limited to the affected banks rather than the industry at large.

Submit the form below and take a closer look at how the recent crisis has affected the stakeholder perceptions and behaviour towards companies in the financial industry.

© 2024 Group Caliber | All Rights Reserved | VAT: DK39314320