What’s happened to the reputation of the UK’s energy sector since 2021?

Perceptions of British energy companies have plummeted in the past two years.

That’s one of the revelations of our latest reputation report – a snapshot of what stakeholders think of the global energy sector – and, as ever, the data tells the story.

At the global level, the reputation of the energy sector hasn’t changed since 2021.

On average, energy companies get the same Trust & LIke Score – our chief reputational metric – as they did two years ago, when we carried out a similar study.

And in some countries – Brazil, France, the US – reputations are even on the rise.

In fact, Trust & Like Scores for energy companies rose significantly in the US.

But the picture isn’t so rosy in the UK.

The average Trust & Like Score for UK electricity companies has fallen three points since 2021, while the score for UK oil & gas companies has dropped seven points.

In other words, British energy companies are significantly less liked and trusted by stakeholders, including customers, than they were two years ago.

And that’s not all.

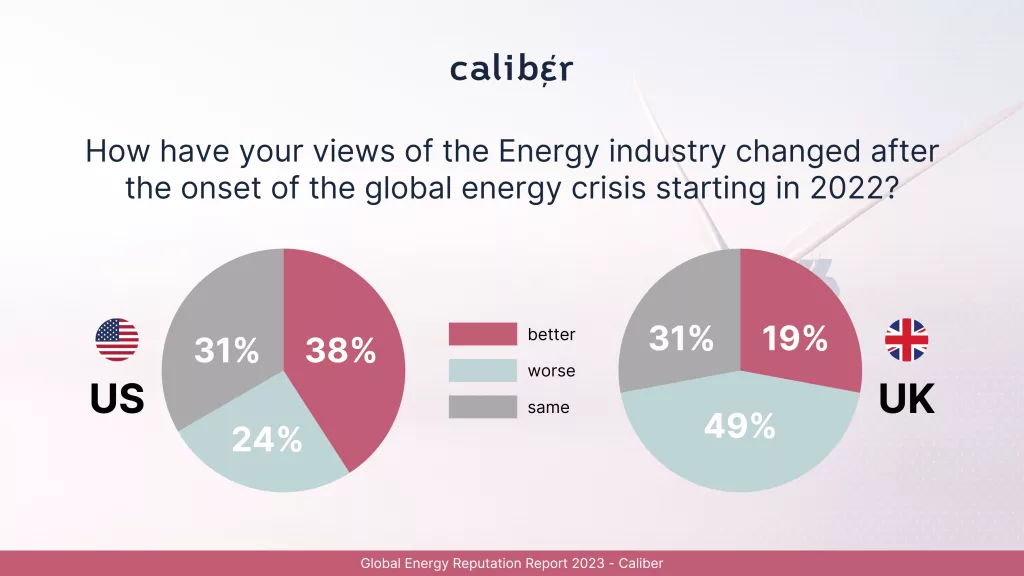

Asked if their views of the sector have changed since the energy crisis began, people in the UK are also much more negative than others.

Only 19% of British people have a better perception of the energy sector than in 2021 – and 49% have a worse perception.

By contrast, 35% of people globally have a better perception of the sector now and 30% have a worse perception.

And 38% of Americans have a better perception, and only 24% a worse one.

So what’s going on?

Why has the UK energy sector’s reputation plummeted since the start of the global energy crisis?

Why are British people comparatively glummer about their energy sector?

Our theory is that the global energy crisis – and the cost-of-living crisis it caused – has significantly dampened British enthusiasm for the energy sector.

Forget anarchy in the UK, then.

What we’re seeing, reputationally, is closer to apathy.

You see, the global energy crisis, exacerbated by Russia’s full-scale invasion of Ukraine in February 2022, meant bigger household bills and higher prices at the petrol pump.

And for many cash-strapped Brits, that only contributed to a cost-of-living crisis.

Throw in all those headlines about energy companies raking in record profits of the back of soaring wholesale prices, and it’s easy to see why their reputations have fallen.

The cost-of-living crisis also helps explain why British people are more likely than the global average to say that lowering energy prices should be a bigger priority for the sector than transitioning to clean energy or reducing emissions.

In fact, almost two in three people (60%) in the UK say keeping energy prices low to ensure wide affordability should be the sector’s top priority. That’s compared to 44% of Americans, a global average of 41%, and just 32% of Germans.

Higher energy bills may have helped drive down perceptions of UK energy companies.

They may have also inspired British billpayers to increase their own energy efficiency.

For instance, British people are more likely than the global average to reduce their use of household appliances and switch to energy-efficient bulbs.

In fact, 57% of respondents in the UK said they’d recently done this – compared to 41% of Germans, 46% of Americans, and a global average of 45%.

Brits are also more likely than the global average to take shorter showers (43% v. 35%), unplug their devices and appliances (45% v 35%), and make their homes more energy-efficient through better thermostats, boilers or insulation (24% v. 19%).

On the other hand, our data shows that British people are less likely than the global average to switch to a more energy-efficient electricity or gas supplier (13% v. 14%), install solar panels, geothermal heat pumps or wind energy solutions (8% v. 12%) or reduce use of air conditioners or upgrade their cooling/heating systems (10% v. 25%).

And that’s not all.

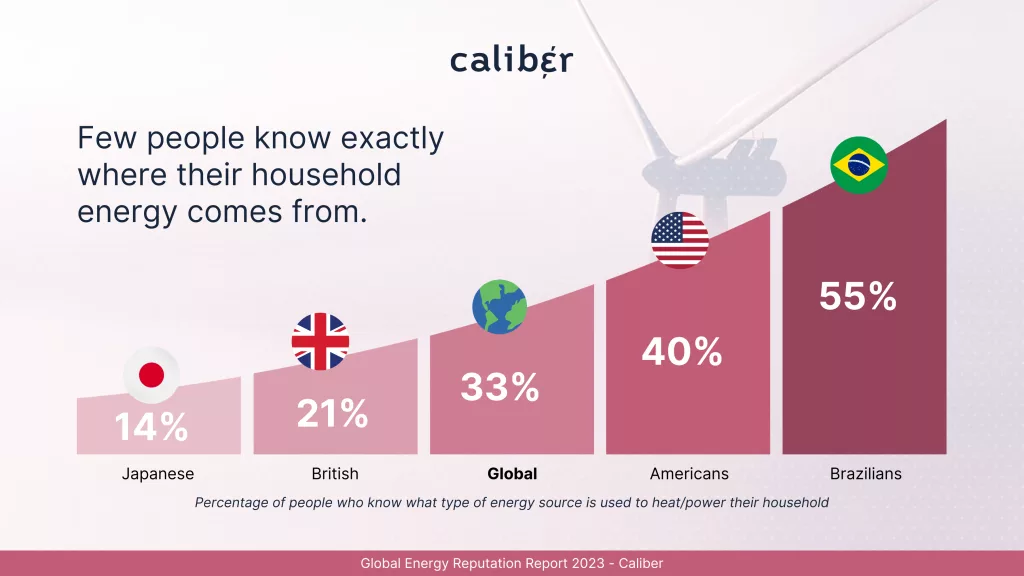

According to our data, British people are among the least aware of what kind of energy powers their households.

In fact, just one in five people in the UK (21%) know their exact energy source. That’s compared to 30% of Germans, 40% of Americans and a global average of 33%.

What does this mean?

First, that there’s a lack of consumer knowledge and education about the energy source and likely the “energy journey” – from extraction to power outlet.

UK energy consumers don’t know “how the sausage is made” and energy companies could do more to educate them about where their energy comes from.

Energy companies could also use that narrative to better communicate their initiatives and improvements – and deepen their relationship with consumers.

Our data also suggests that British energy companies may want to assume more responsibility for their impact on society and show people what they’re doing to meet their expectations – such as educating them about money-saving energy consumption.

In other words, helping Brits become better energy consumers could go a long way toward helping British energy companies rebuild their battered reputation.

© 2024 Group Caliber | All Rights Reserved | VAT: DK39314320