2023 Trust & Like Score Rankings

Find out which companies were the most Trusted & Liked in some of the key global stock indices in 2023.

Our annual Employer Attractiveness ranking never fails to surprise — and this year’s results were no exception.

Which companies are the world’s most attractive employers?

To find out, we asked people in ten countries — including France, Germany, the UK and the US — about companies listed on their respective stock indexes (or, in Belgium, their 30 largest companies).

First, we asked people whether they were familiar with each company. Then we asked them if they’d consider each of the companies a place to work if they were looking for a job.

Individually, the results in each market speak for themselves.

But what about when they’re taken together? Do any patterns emerge? If so, what might they tell us about corporate reputation and its relation to employer attractiveness?

A closer look at this year’s results reveals the following seven trends.

Our chief metric of corporate reputation is the Trust & Like Score (TLS), which does what it says on the tin — it measures how trusted and liked a company is among its relevant stakeholders.

A counterpart to the Employer Attractiveness (EA) ranking, our annual TLS ranking reveals which companies have the best and worst reputations in their home markets.

Find out which companies were the most Trusted & Liked in some of the key global stock indices in 2023.

Laying them side by side, it’s tempting to ask how much the two rankings overlap or correlate. In other words, are the most trusted and liked companies also the companies that respondents deem the most attractive as potential employers? In a word, no.

Consider this, for starters: in none of the eight markets in which we surveyed people for both rankings are either the top five or the bottom five companies the same in each case.

There’s usually an overlap of two or three companies, but otherwise, there’s a lot of flux — suggesting that just because a company has a high or low TLS, it doesn’t necessarily mean it’ll have a high or low EA score, and vice versa.

In some cases, companies rank very differently across the two rankings. In Germany, for instance, Adidas was crowned the most trusted and liked company in 2023 — but came just 17th in the more recent Employer Attractiveness ranking. Ditto for TESCO in the UK: it came second in the TLS ranking but 20th in the EA ranking.

Some went in the opposite direction. In the UK, mining giant Anglo-American ranked 44th in the TLS list but fifth in Employer Attractiveness, while pharmaceutical firm GlaxoSmithKline came 25th in the TLS ranking and third in the EA ranking.

Similarly, Alphabet ranked 39th in our 2023 TLS ranking of US companies but second on our EA ranking, while food processing giant ADM ranked 31st on the TLS list but fourth on the EA list. Likewise, Dassault Systèmes came 23rd in our ranking of Trust & Like Scores among CAC40 companies and second in our EA ranking.

What’s going on here? Simply put, it shows that corporate reputation comprises a myriad of factors — including rational perceptions of brand, reputation and ESG impact, as well as behavior such as the likelihood of recommending or buying the company’s products or indeed considering them as a potential employer.

Put another way, plenty of people might trust and like a company but not want to work for it, while in some sectors, “industry insiders,” including potential employees, might downplay or disregard certain reputational attributes when considering a company.

For instance, if you’ve chosen to work in mining, you probably want to work for a mining company more than someone outside the industry, who probably also perceives the company (and the sector) less favorably.

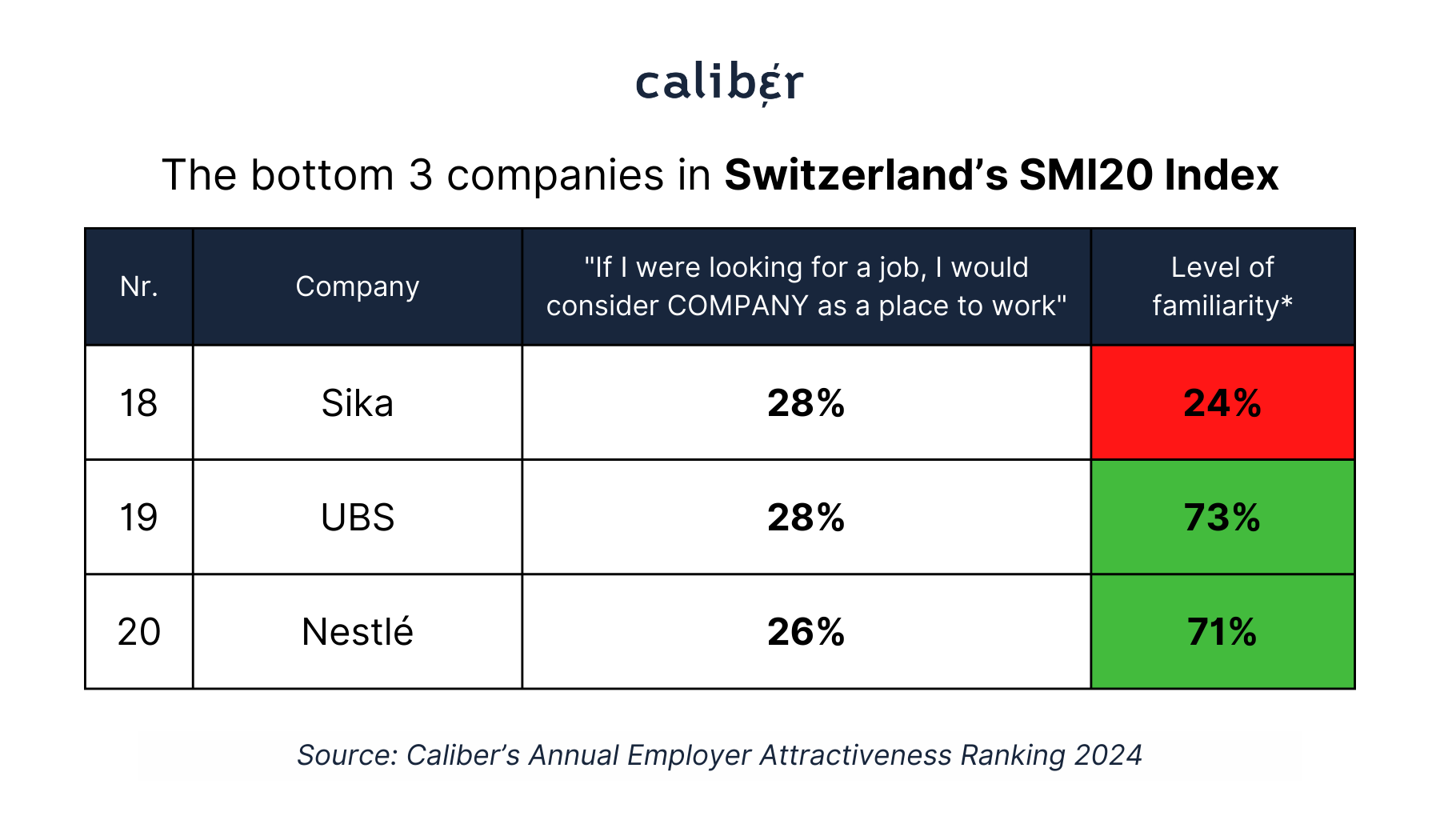

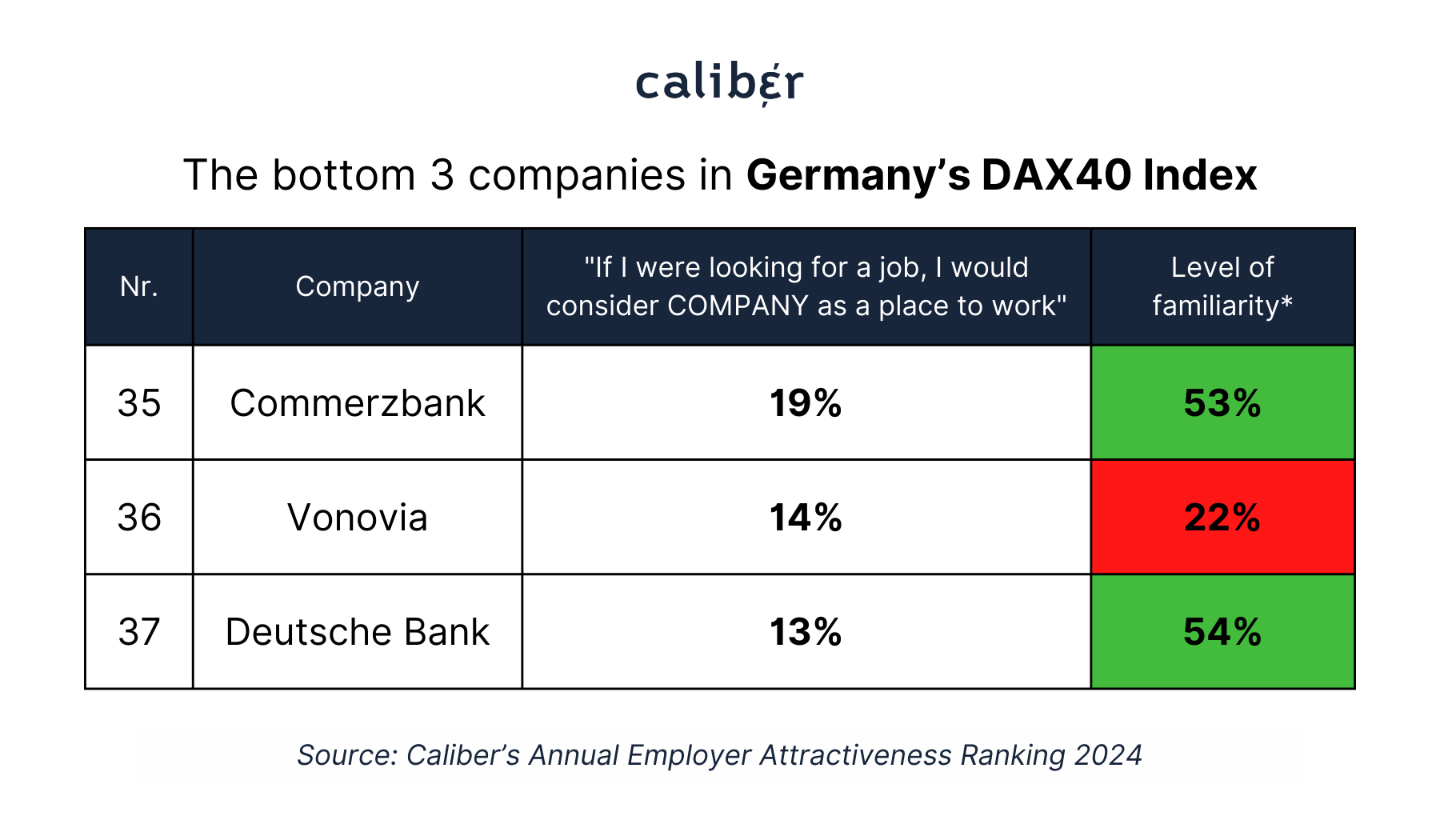

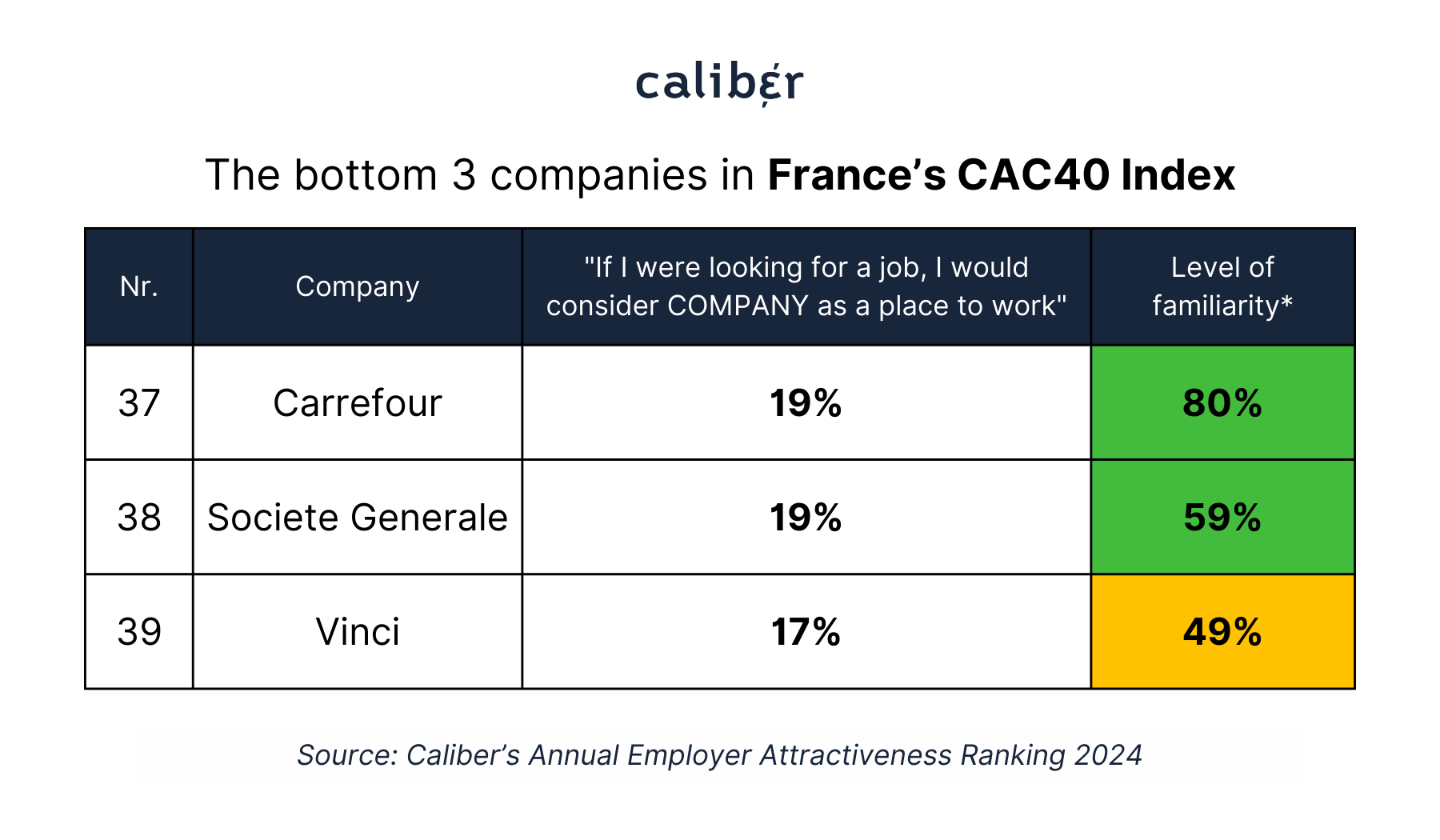

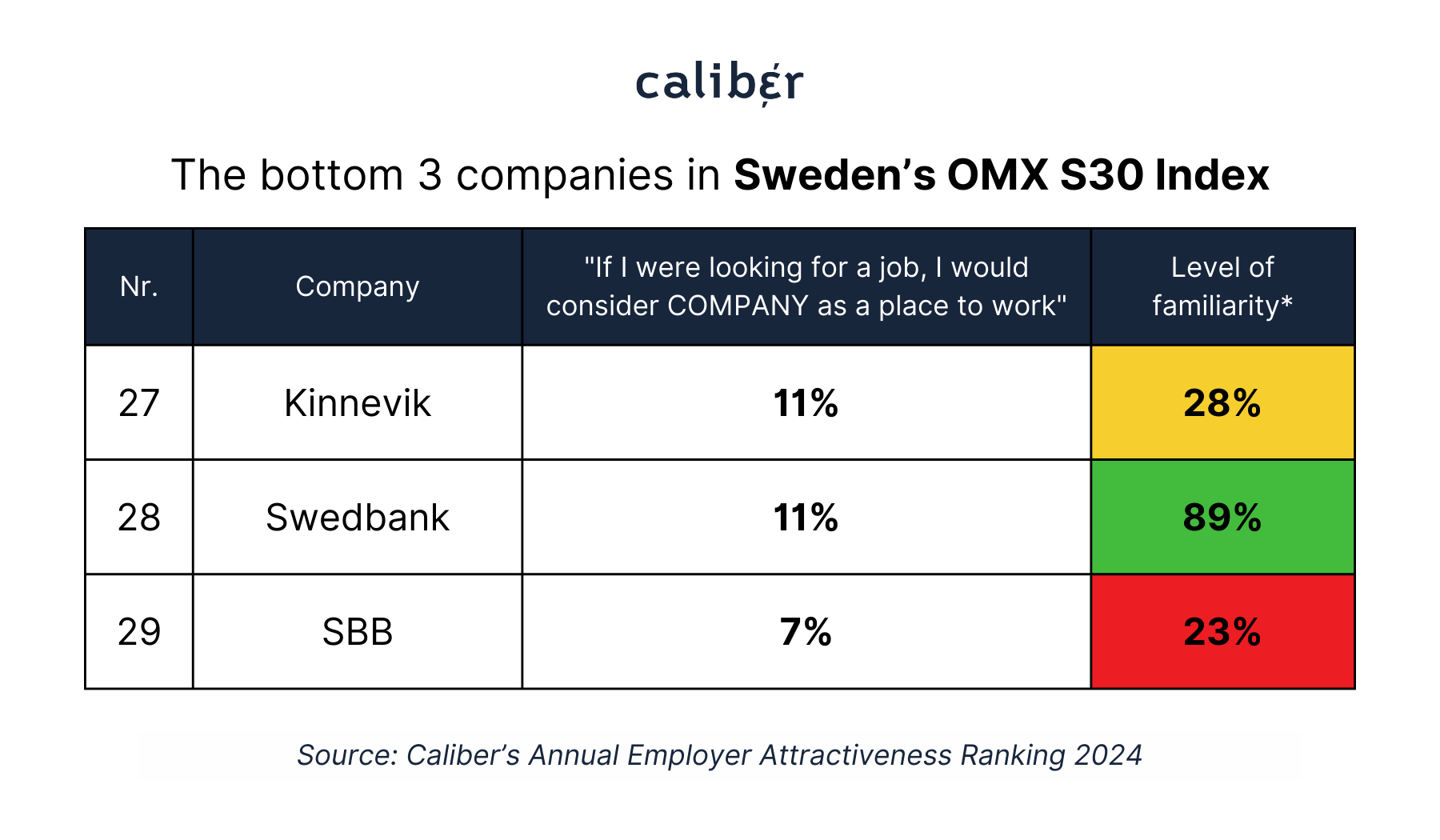

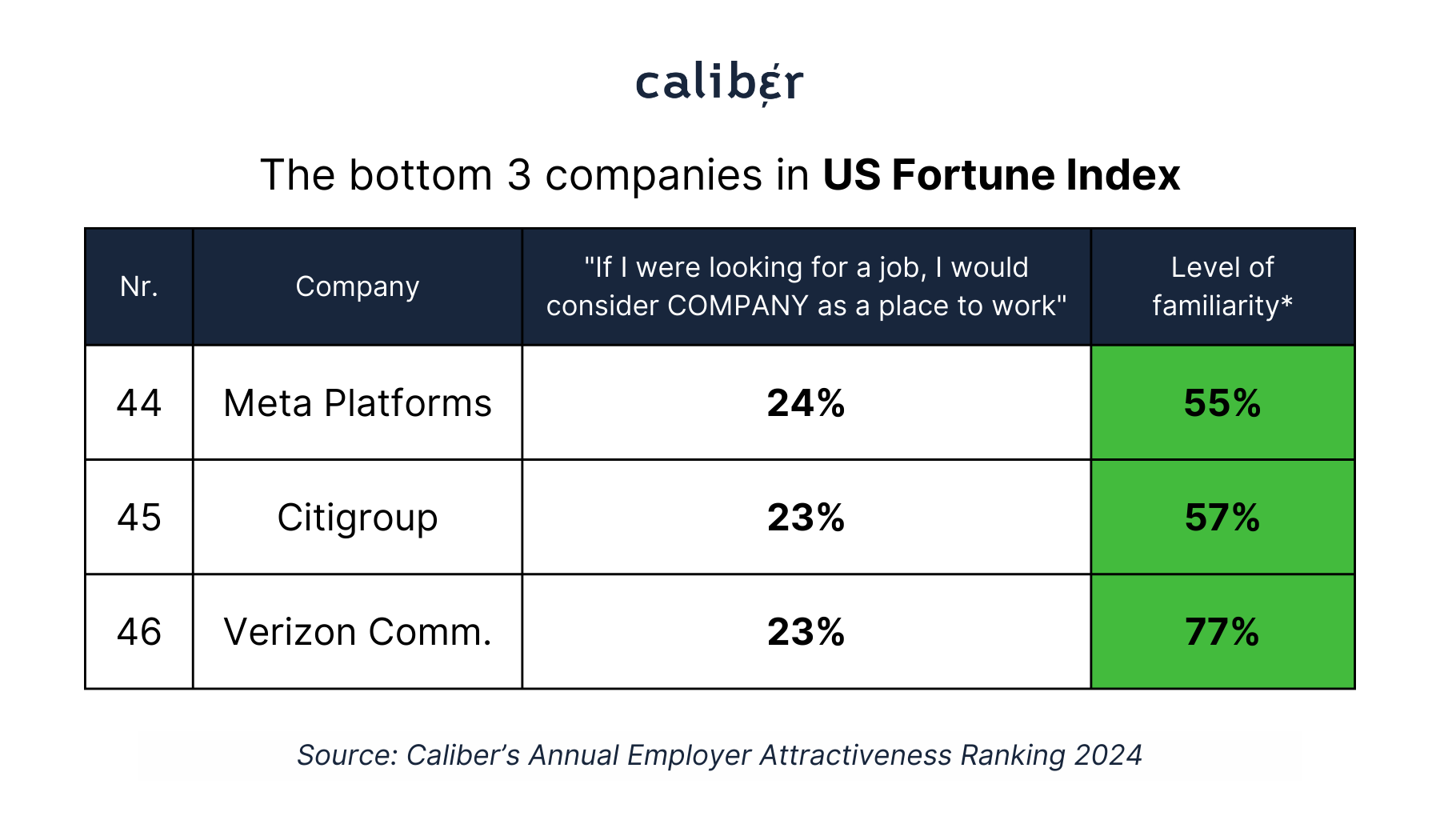

Commercial banks dominate the bottom spots in most markets this year. Deutsche Bank is in last place in Germany; UBS, Swedbank, Société Générale and Citigroup are all second from bottom in Switzerland, Sweden, France and the US, respectively; Commerzbank and Nordea round out the bottom three in Germany and Finland, respectively; and three banks comprise the bottom of the Danish ranking — Danske Bank, Jyske Bank and Nordea.

A brief glance at recent headlines might explain some of these lowly rankings: Deutsche Bank announced in February that it is cutting around 3,500 jobs as part of an ongoing “operational efficiency” program, while UBS is grappling with perceptions that it’s too big for Switzerland and requires tougher regulation following its takeover of Credit Suisse.

Meanwhile, for Scandinavian banks Nordea, Swedbank and Danske Bank, the money-laundering scandals of 2018 may still cast a long shadow over their appeal to potential employees.

A counterpoint comes from the UK, where three banks appear in the top half of the ranking: Lloyds, HSBC and Standard Chartered, which is rated the UK’s most attractive employer.

Online reviews highlight the latter’s “good work-life balance”, with most employees spending just two to three days in the office. The relatively high ranking of UK banks may reflect more positive perceptions of the banking sector there than elsewhere, thanks to the importance of the City.

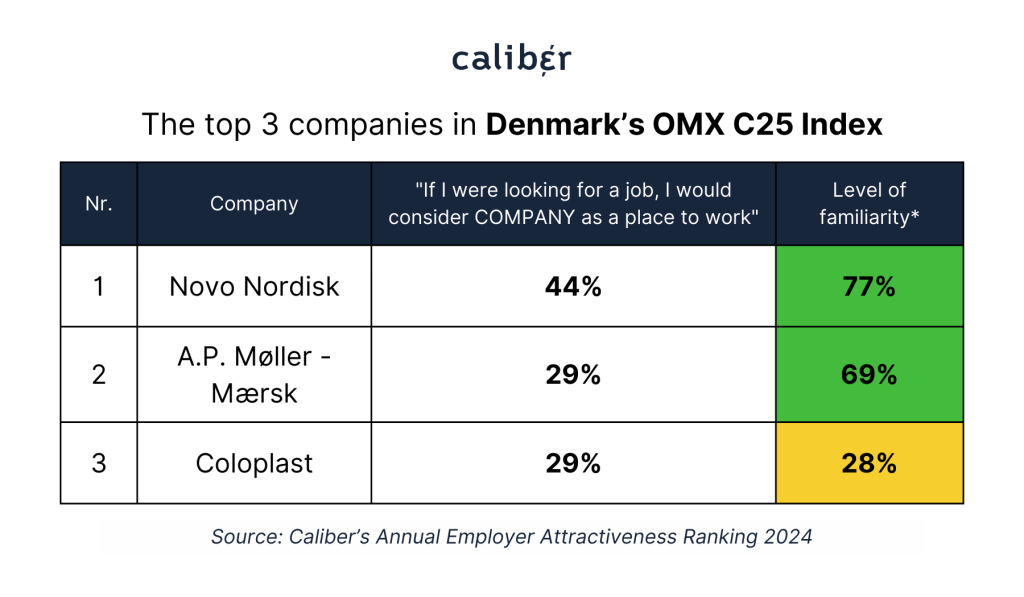

If banks are the least attractive employers, pharmaceutical firms — and companies in adjacent fields such as medical devices and biotechnology — are the most attractive.

For instance, the most attractive employer in Denmark is pharma giant Novo Nordisk, while four other healthcare-adjacent companies (Coloplast, Genmab, Bavarian Nordic and Demant) make the Danish top 10. (Novonesis, the result of the 2024 merger of biotech companies Novozymes and Chr. Hansen, fell below our 5% familiarity threshold and so does not appear in the ranking. Had the individual companies been included in their own right, both would have ranked in the top three.)

In Switzerland, meanwhile, the top spots are claimed by audiology giant Sonova and eyecare company Alcon. Belgium’s top-rated company is pharmaceutical company Janssen (recently renamed Johnson & Johnson Innovative Medicine).

The runner-up there is Spadel, which bottles mineral water. Healthcare services company Siemens Healthineers is Germany’s third-most attractive employer, while pharma giant GlaxoSmithKline takes third place in the UK.

What might explain this trend? Well, as employees increasingly seek jobs that give them purpose and make a difference in people’s lives, it’s clear that the healthcare industry provides many attractive career opportunities. The smash success of weight-loss drugs Ozempic and Wegovy — produced by top-rated Novo Nordisk — typifies this trend.

One outlier? Pfizer, which ranks 39th in the US, with just 27% of respondents saying they’d consider looking for a job with the pharma giant. The halving of Pfizer’s stock price since its peak in late 2021 may have dampened enthusiasm. It also produced one of the COVID-19 vaccines: might US vaccine skepticism explain perceptions of Pfizer as a potential employer?

Telecommunications is another sector that performed relatively poorly this year. In fact, telecom companies rank among the least attractive employers in several markets. Verizon comes bottom of the US ranking, with rival Comcast just three places above it. Telecom Italia’s subsidiary TIM takes the bottom spot in Brazil, Telenet is ranked second-last in Belgium, as is Telia in Finland. Tele2 is among the four least attractive employers in Sweden.

What’s interesting about Verizon, though, is that it’s America’s most Trusted & Liked telecom company, according to our recent global sector report.

Our latest report shines a light on the Telecoms sector — and shows the current reputation of its biggest companies.

In other words, the informed public trusts and likes it more than its rivals — indeed, our report revealed its reputational advantages lie in its capacity for innovation, inspiration and differentiation — but it’s perceived as a less attractive place to work. And it isn’t hard to see why: the company slashed almost 12,00 positions in 2023 and let another 1,000 employees go in January.

Our sector report also explored why telecom companies have a relatively poor reputation. Of the 16 sectors we track, its reputation is better only than the energy sector — and fewer than a third of respondents in the survey for that report would consider seeking a job in the sector.

That tracks with the low levels of employer attractiveness in our more recent survey — and, again, it isn’t hard to see why. Job losses were rife across the sector last year — and it also picked up negative headlines about data security, price rises and contract transparency, which may also have dampened enthusiasm for seeking a job in the sector.

It should come as no surprise that many energy companies are close to the bottom of the national rankings this year. For instance, Centrica and BP are the lowest-ranked FTSE 100 companies, and Luminus is in last place in Belgium.

Our recent energy sector reputation report considers reasons for energy’s poor reputation, including mounting fears about climate change and the prominent role of fossil fuels, higher household energy bills and the perception that the sector isn’t doing enough to educate consumers about where energy comes from and what’s being done through innovation and partnerships to make energy both cheaper and cleaner.

Find out how world’s largest energy companies are perceived by their stakeholders in 2023.

As with telecoms, the relatively low ranking of energy companies in this year’s Employer Attractiveness poll mirrors the findings of our sector report, in which just a third of respondents, on average, said they’d consider the energy companies included in the report as a place to work if they were looking for a job.

Two sectors performed relatively well this year: the automotive sector and what one might call the broader “goods and services” sector, comprising everything from high-end fashion and premium liquor to umbrella groups for FMCG and online commerce.

Take the automotive sector first: Rolls-Royce is the UK’s second-most attractive employer, while Daimler Trucks and Mercedes-Benz are Germany’s two most attractive employers. BMW is in ninth place and Porsche twelve. Volvo Group is the eighth-most attractive employer in Sweden.

The ranking of these companies may say something about the allure of the automotive industry — and the prestige of working in it. It may help, too, that these companies are household names and, in most cases, make desirable consumer goods.

That factor may also explain the relative appeal of companies that sell or own consumer-facing brands.

Switzerland’s fourth-most attractive employer is luxury goods group Richemont, while France’s sixth-most attractive employer is the high-end fashion conglomerate LVMH, known for labels such as Louis Vuitton and Dior and liquor brands Hennessy and Moët & Chandon. In the UK, FMCG umbrella group Unilever is the sixth-most attractive employer, while web shopping giant Amazon is America’s third-most attractive employer, with the Walt Disney Company in eighth place and big-box retailer Costco in ninth.

The high degree of familiarity with the consumer goods owned and operated by these umbrella groups may explain why they appeal as potential employers. In this respect, the more visible a company’s products or brands are, the more attractive they might be.

Of course, this isn’t always the case — as the low ranking of consumer-facing companies such as Nestlé (bottom in Switzerland), C&A (second from bottom in Brazil), Carrefour (second from bottom in France), Pandora (fifth from bottom in Denmark), and H&M (sixth from bottom in Sweden) attests. And that brings us nicely to the final trend.

A quick glance at the rankings — and our color-coding system in particular — reveals something interesting about how companies are perceived. For the most part, the more familiar people are with them, the less likely they are to want to work for them.

Consider, for instance, the rankings for France, Germany and the UK. In each case, the top half is a sea of red — meaning less than 25% of respondents were familiar with the companies in question. (We excluded from the EA ranking all companies below 5% familiarity as they were considered too niche to be comparable.) By contrast, the bottom half is a field of green — meaning more than half of respondents were familiar with those companies.

This discrepancy could mean one of two things. First, that the most attractive employers achieve that status despite the public being less familiar with them because people who are familiar with them are better informed than average (such as being an industry insider or a current or former employee of a company in that sector). To put it another way: if 50% of the 10% of respondents who are familiar with a company say they would consider seeking a job at that company, it isn’t hard to see how the company could top the poll.

By comparison, people are likely to be more familiar with companies that are consistently in the public eye and under scrutiny from regulators, journalists and activists. What people know about those companies may be enough to extinguish enthusiasm for ever working there.

As ever, there are significant outliers such as Denmark’s most attractive employer, Novo Nordisk (77% familiarity), France’s fourth-most attractive, Airbus (50%), and Sweden’s eighth-most attractive, Volvo Group (84%). Here, familiarity breeds anything but contempt.

Then there’s the US, which confounds the trend entirely. Just 14 companies (of 46) have familiarity levels below 50%; three of the top five — FedEx, Amazon and The Home Depot — have familiarity levels of at least 85%.

These relatively high levels (matched only by Belgium and Brazil) suggest a relatively “employer-literate” public, perhaps informed by robust coverage of companies at the local, regional and national level, as well as by the greater involvement of corporate America in everyday life, from sports sponsorship to media advertising.

© 2024 Group Caliber | All Rights Reserved | VAT: DK39314320